Every company has costs in the course of its business. Therefore, the company’s finance staff sets the company’s budget based on these costs.

If you have a good understanding of your company’s business expenses, you can create a more accurate budget based on those expenses and track your business expenses against the budget sheet.

The common categories of company business expenses are as follows.

- business premises rental costs

- Utility costs, such as water, electricity, heating, landline telephone, Internet costs, etc.

- Business Insurance

- Office Equipment

- Employee Salary

- various marketing expenses, such as advertising, flyers, website, etc.

- taxes and fees

A business budget is an essential part of your company’s overall business plan and is necessary to do the business of your company. Once your business is established, a business budget becomes a regular task for your company.

A reasonable business budget should contain the following elements.

- The estimated revenue of the company

- The fixed costs of the company’s operations

- The variable costs of the company

- One-time costs

- Cash flow

- Profit of the company

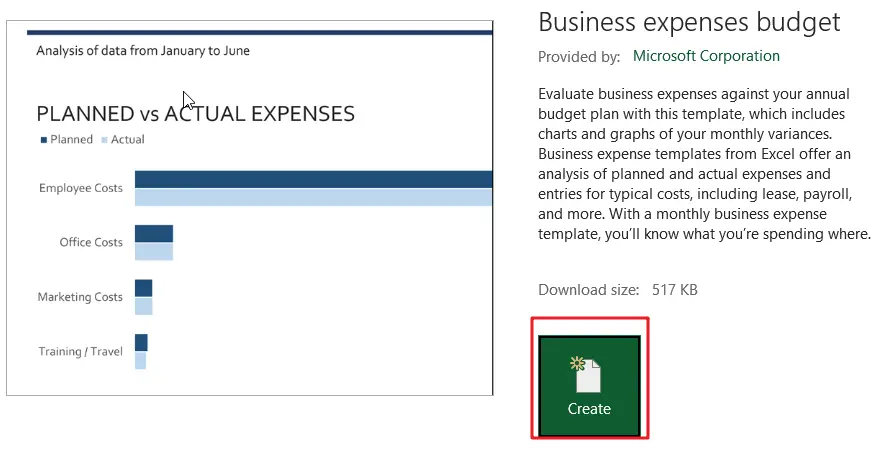

This article will introduce a free Excel business expense budget template that evaluates a company’s business expenses against an annual budget plan, including charts and graphs of expense variances for each month. The business expense template also provides an analysis of planned and actual expenses as well as typical cost entries.

Business Expenses budget

This Business Expenses budget is officially provided by Microsoft Excel, you can create the template directly in Microsoft Excel Application or download the template through the official website.

You can use this business expense budget template to evaluate your company’s business expenses based on your annual budget plan.

This template contains 4 sheets: Planned Expenses, Actual Expenses, Expense Variances, Expenses Analysis.

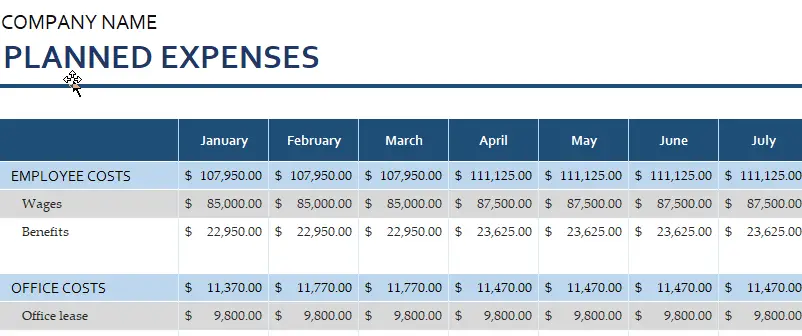

- Planned Expenses: This sheet contains the planned expense amounts of the company for all business categories in each month, which contains the following business expense categories: EMPLOYEE COSTS, OFFICE COSTS, MARKETING COSTS, TRAINING /TRAVEL, etc.

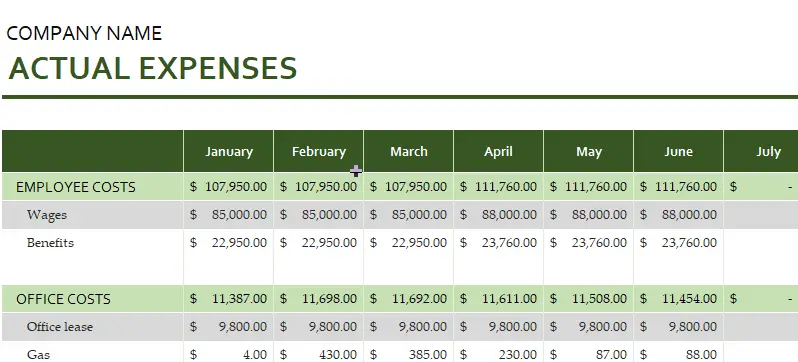

- Actual Expenses: This sheet contains the actual expense amounts of the company for all business categories in each month, which contains the following business expense categories.: EMPLOYEE COSTS, OFFICE COSTS, MARKETING COSTS, TRAINING /TRAVEL, etc.

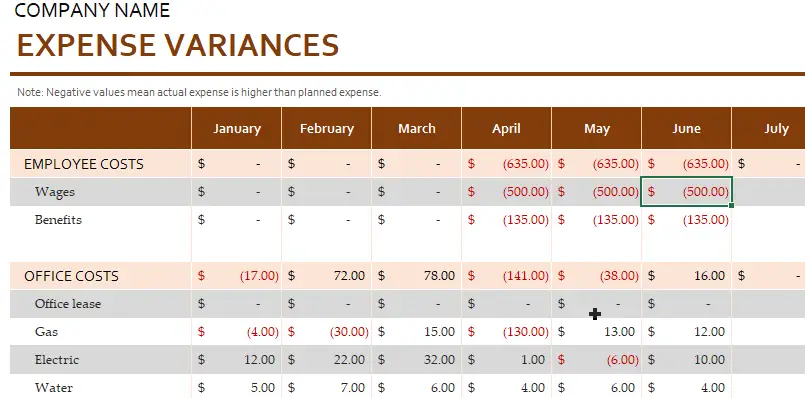

- Expense Variances: This page contains the company’s monthly expense variances for all business categories.

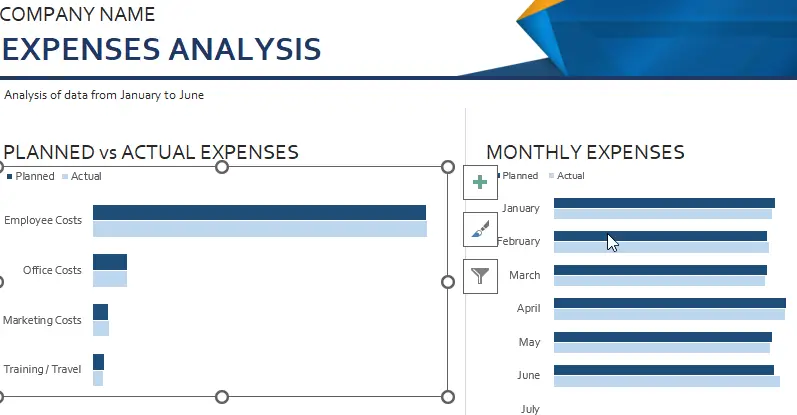

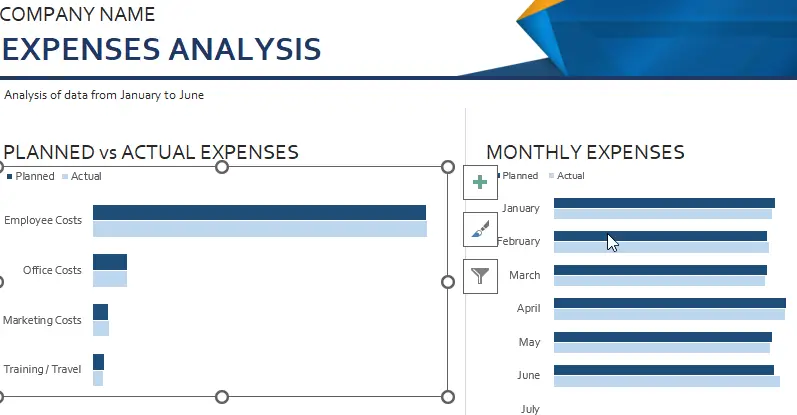

- Expenses Analysis: This sheet contains a comparison of the company’s planned and actual expenses for the year, as well as a comparison of actual and planned expenses for each month.。

Let’s look at how to use this business spend budget template:

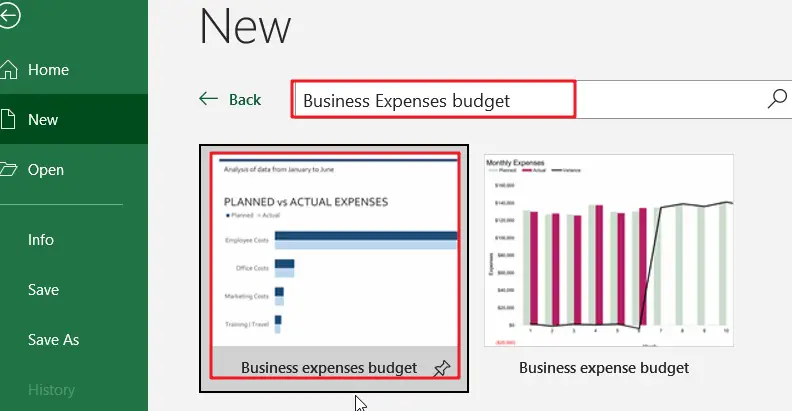

Step1: Open the Microsoft Excel Spreadsheet application, click on the File menu, and then click on the New sub-menu.

Step2: In the New dialog box, find the Template search box, enter the keyword “Business Expense Budget” and press Enter, you will see the Business Expense Budget template.

Step3: Click the Create button to download the selected Business Expense Budget template to create a new Business Expense Budget spreadsheet.

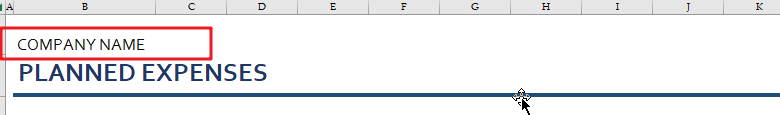

Step4: You need to enter your company name in Cell B2 in Planned Expenses sheet.

Step5: You need to enter the monthly planned expense amount for each business expense entry for your company in the Planned Expenses worksheet.

Step6: You need to enter the monthly actual expense amount for each business expense entry for your company in the Actual Expenses worksheet.

Step7: When you enter the relevant expense data in the Planned Expenses and Planned Expenses worksheets, the expense variances in the Expense Variances worksheet are also calculated automatically.

Step8: In the Expense Analysis worksheet, you can see two expense comparison bars, one for planned and actual expenses for the year, and the other for each month.

If you are looking for Business Expenses budget template, check out Microsoft office site by clicking here.

Leave a Reply

You must be logged in to post a comment.