This post will guide you how to use Excel AMORLINC function with syntax and examples in Microsoft excel.

Table of Contents

Description

The Excel AMORLINC function returns the linear depreciation of an asset for each accounting period. This function is provided for French accounting system.

The AMORLINC function is a build-in function in Microsoft Excel and it is categorized as a Financial Function.

The AMORLINC function is available in Excel 2016, Excel 2013, Excel 2010, Excel 2007, Excel 2011 for Mac.

Syntax

The syntax of the AMORLINC function is as below:

= AMORLINC(cost, date_purchased, first_period, salvage, period, rate, [basis])

Where the AMORLINC function arguments are:

- Cost -This is a required argument. The cost of the asset.

- Date_purchased – This is a required argument. The date that the asset was purchased.

- First_period – This is a required argument. The date of the end of the first period.

- Salvage – This is a required argument. The salvage value at the end of the life of the asset.

- Period – This is a required argument. The period in which to calculate the depreciation.

- Rate– This is a required argument. The rate of depreciation.

- Basis – This is a required argument. The year basis to be used. The following values can be used:

| Basis | Date system |

| 0 or omitted | 360 days (NASD method) |

| 1 | Actual |

| 3 | 365 days in a year |

| 4 | 360 days in a year (European method) |

Excel AMORLINC Function Example

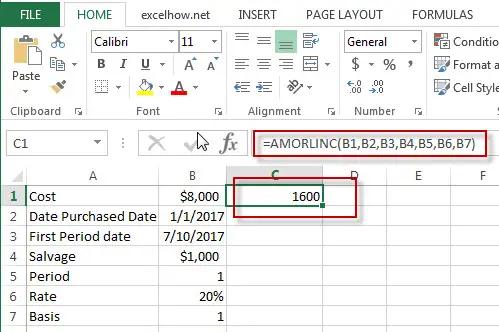

The below examples will show you how to use Excel AMORLINC Function to calculate the linear depreciation of an asset for each accounting period.

#1 = AMORLINC (B1,B2,B3,B4,B5,B6,B7)

Related Functions

- Excel Amordegrc Function

The Excel AMORDEGRC function returns the linear depreciation of an asset for each accounting period by using a depreciation coefficient.The syntax of the AMORDEGRC function is as below:= AMORDEGRC (cost, date_purchased, first_period, salvage, period, rate, [basis])…

Leave a Reply

You must be logged in to post a comment.